As healthcare costs continue to rise and population health worsens, employers are taking a hard look at their benefits packages to determine what programs are impacting cost and outcomes—and which aren’t delivering.

This year’s Health Care Strategy Survey from Business Group on Health asked 125 large employers covering more than 17.1 million people about their plans to manage a decade-high projection in healthcare cost increases while continuing to provide excellent care to employees.

These five key takeaways from the survey stood out–and closely mirrored insights from Lantern clients.

1. Healthcare Costs Expected to Grow at the Highest Rate in a Decade

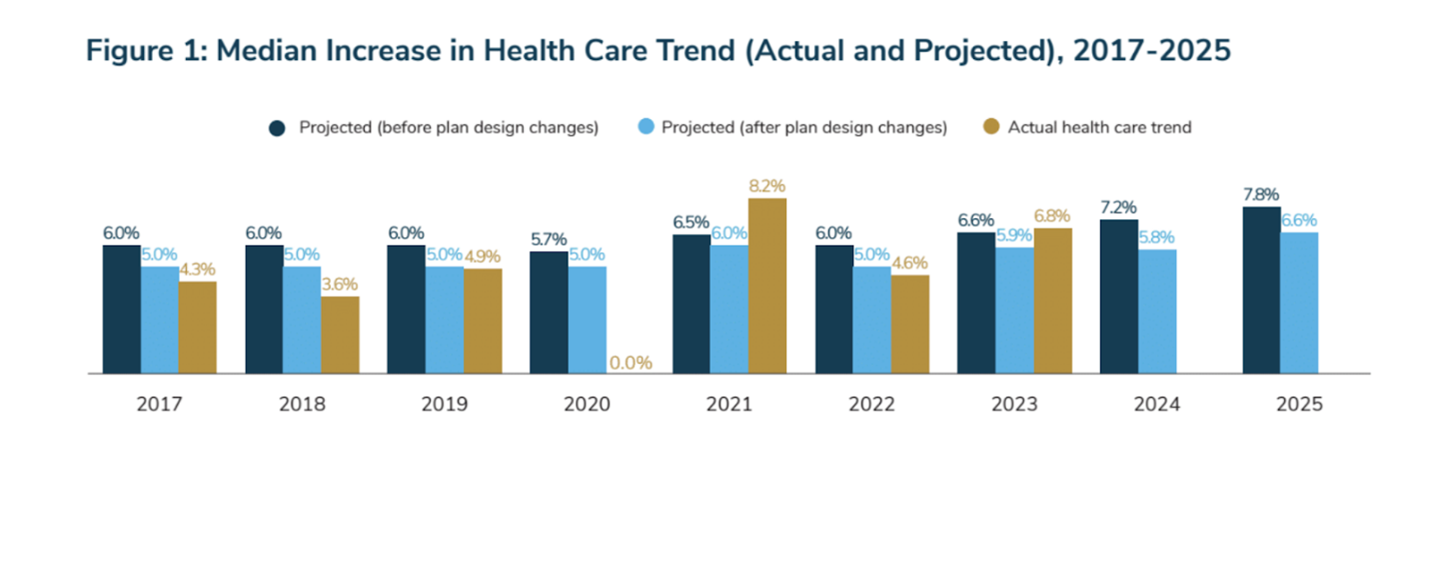

Before plan changes, the projected increase in healthcare costs is expected to land at 7.8% in 2025, the highest projection seen by this survey in 15+ years. The data shows that even after plan changes, healthcare costs continue to grow at a rate that outpaces pre-pandemic levels — accounting for a more than 50% increase in healthcare costs since 2017.

In order to provide access to quality care, employers have and continue to largely absorb these cost increases. Employee contributions to their health insurance premiums have risen approximately 11% over the last five years, compared to employer contributions, which have risen nearly 37%.

Despite high costs, the majority of employers remain committed to offering access to high-quality care.

We also hear from Lantern clients that they’re looking to provide employees with an excellent benefits package that they can afford to use, avoiding high premiums and cost share.

Derek Butts, Benefits Manager at Phillips 66, shared that because they save so much through Lantern Surgery Care, they’re able to waive most out-of-pocket costs for employees.

“How can we really level the playing field across the economic spectrum for our employees so that you can get great care with a great surgeon in your area regardless of how much you make? That story is extremely powerful,” he shared.

2. Cancer and Musculoskeletal Lead Top Conditions Driving Costs

Cancer remains the top condition driving cost, as more young people receive diagnoses and treatments become more complex. As such, employers are adopting strategies to address treatment costs and amplifying efforts to increase cancer prevention awareness.

Musculoskeletal conditions are the second-costliest condition by a margin of more than 30%.

Laura Wallace, Director, Total Health at Lantern customer ArcBest, shared that MSK costs were always number one or two at her company until they brought on digital PT solution Sword and a COE program through Lantern.

“We have seen that MSK classification of cost go down to about half of what it was actually in ‘21,” she said. “So our projected cost for ‘24 is a 50% decrease in MSK cost. And it is now coming in at about number five in our diagnostic categories.”

3. Employers Consider Assessing Vendor Partnerships to Cut Costs

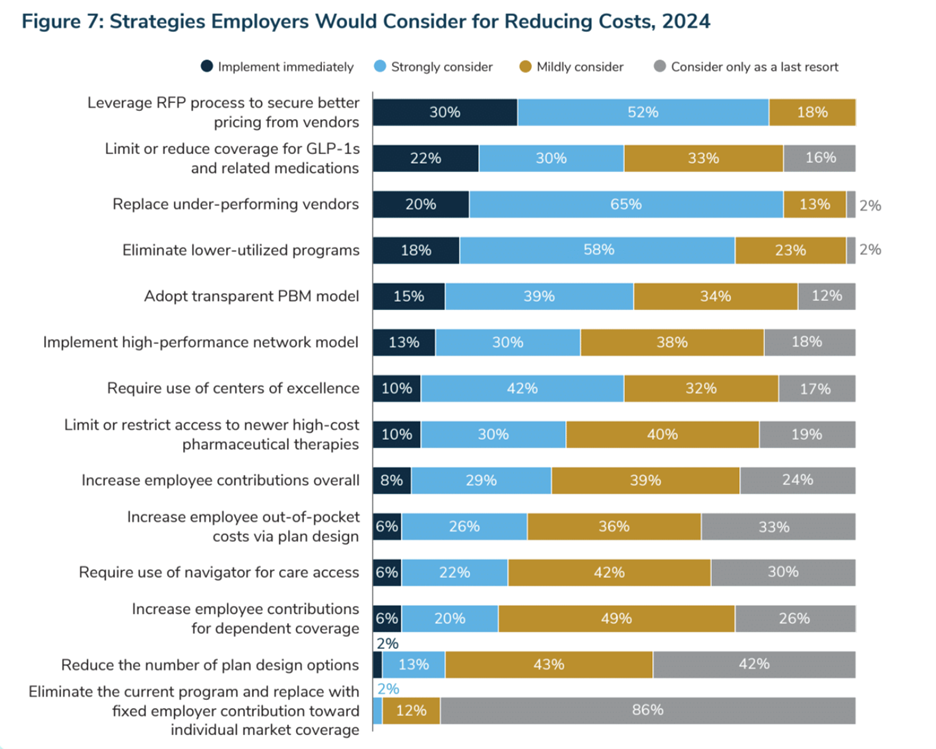

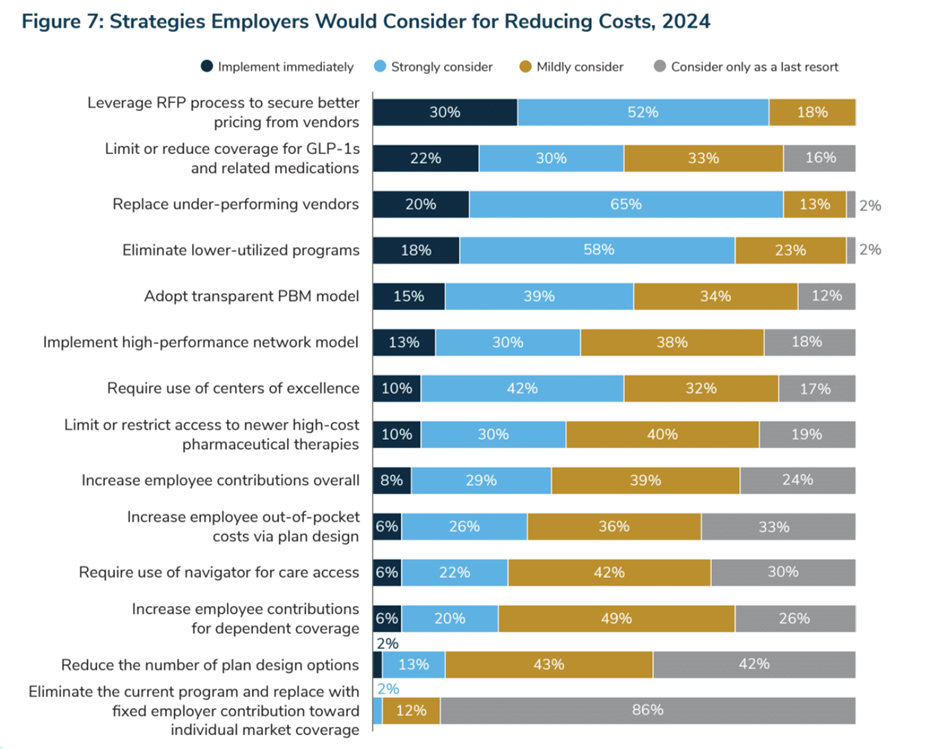

When asked about measures employers would consider if forced to cut costs to prior-year levels, an overwhelming majority of employers listed leveraging the RFP process to secure better vendor pricing as a top option. 85% say they would implement immediately or strongly consider replacing underperforming vendors.

In general, employers are reassessing the quality of their vendors in an effort to reduce costs and simplify the member experience. They expect a greater value and stronger commitment from their vendors.

As a licensed third-party administrator, we’re able to share detailed claims and utilization data. Derek Butts of Phillips 66 recommends digging into the data COE solutions share during your evaluation process, too.

“Yes, the reduction in rates is important, but I think the question of the reduction from what is equally important,” he said. “Don’t give me a reduction on a national average. I need a reduction on a geographically appropriate amount. And I also want to see data that supports that. I’ve asked the [Lantern] team that question many times, and they have thankfully obliged and given me that information, but I have seen some very weird math in my career on calculating savings.”

4. Respondents Consider Requiring Use of Centers of Excellence and Expanding Condition Areas

As another cost-cutting strategy, 42% of respondents say they would strongly consider requiring the use of centers of excellence, while 10% would implement a COE requirement immediately if forced to reduce health care plan costs to prior-year levels.

Many employers already leverage COEs as a delivery reform method for improving the quality and appropriateness of care.

While requiring employees to use a COE for certain procedures can lead to cost savings, it can also create friction in the employee experience. At Lantern, many of our clients choose to waive member cost-sharing, including deductibles and co-insurance, so employees pay nothing out-of-pocket for their procedure. Employers can offer these incentives with or without requiring COE utilization.

Employers are also considering expanding how many condition areas or procedures they cover through a COE.

At Lantern, we cover thousands of procedures as part of our surgery care program. Covering more procedures creates a simpler member experience and more opportunities for savings, too. At Phillips 66, for example, 60% of the procedures employees have received so far this year wouldn’t have been covered by a traditional COE that only performed major orthopedic surgeries.

5. Eliminating under-performing vendors

In addition to renegotiating pricing, 76% of respondents were either strongly considering or planning to immediately eliminate lower-utilized programs.

In traditional COE models, utilization tended to be low because carriers couldn’t steer members to specific locations or because the program required travel. At Lantern, we’re able to deliver better utilization in part because of our network coverage: 98% of our members are able to drive to their provider.

“We looked at some [COE solutions] that were specialized on the two coasts. That’s not necessarily where we have our strongest population. We needed coverage for all 50 states. And I think it’s especially important, how far does someone have to travel?” said Laura Wallace. “That’s the biggest challenge for somebody wanting to get a surgery done and convincing them that they should maybe go to a different place.”

As employers re-evaluate their benefits packages for cost, engagement and quality, Centers of Excellence stand out as an impactful solution—but only if employees are able to easily use them.